Long term care planning is easy to do. Only a small change to your portfolio can help you pay for future long term care (LTC) expenses.

Here’s my top money tip for huge LTC benefits: By simply repositioning assets you already have, we can generally create a multiple of at least three to four times your initial amount in LTC benefits, and frequently much more.

Today, 84% of people choose newer “hybrid” insurance options over traditional LTC insurance products because all or most of your initial investment can be recovered if you never use the policy or you decide to use your money for other purposes, and your insurance costs can never increase.

How many family members or friends do you know who either benefited from their LTC planning, or wish they had done it sooner?

The peace of mind in knowing you can easily obtain the level of LTC assistance you might require is a huge relief not only for you, but also for your family so that they can focus more on attending to your personal needs, and their own, instead of needing to be health care providers.

Furthermore, proper LTC planning allows you to bring the services you need to your home, as the vast majority of individuals prefer. Why leave everything you enjoy and are comfortable with at home if you don’t have to?

So What Does The Data Show?

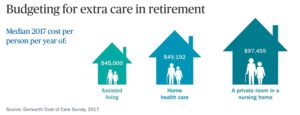

Recently published statistics show that almost 70% of individuals over age 65 today will use LTC services for an average of 3-4 years; 20% will use services longer than 5 years. Even though most elderly people only need some help at home with daily living activities, these costs add up to more than you might realize.

At today’s rate, just 6 hours a day of home health assistance adds up to $50,000/yr. If you need help for a ten year period, say from age 80 to 90, the total cost would be $500,000. For someone age 60 today with 20 years before reaching age 80, this cost grows to $1,095,562 at the historical average annual inflation rate of 4% for medical expenses. Keep in mind that statistics show we have a 30-50% probability of reaching age 95!

Are You Covered?

Insurance companies paid out $10.3B for LTC claims in 2018. Even a perfectly managed portfolio will be significantly depleted unless you have a plan for covering LTC expenses. Many insurance and non-insurance options are possible, and the sooner you begin planning more of these options will be available to you.

Get in contact today to begin your long term care planning